I live in downtown New York City, right next to the Hudson River.

About ten years ago, Superstorm Sandy landed here and caused $19 billion in damage. Many of my neighbors were forced to move uptown or out of town to escape the flooding.

The thing is, this wasn’t an isolated event…

According to the Global Displacement Database, nearly ten million people were displaced by various natural disasters in the U.S. between 2008 through 2020.

As The New York Times recently summed it up, “The great climate migration is already here.”

Now, look: this isn’t a political newsletter. So I’m not going to preach about climate change, or get into a debate about whether it’s real or not.

This is an investment newsletter. And that’s why, today, I’ll explain how climate migration is impacting real-estate investing already — and reveal how to profit from it.

Specifically, I’ll reveal three states expected to be crushed by it, and three states that will soar.

Let’s dive in.

A Decade of Solutions

For more than ten years now, our mission at Crowdability has been clear:

To help people like you take advantage of investments that are outside the stock market.

Some of these investments are in private startups. Why? Simple. Because historically, startups have returned up to 10x more than the stock market.

But we also cover other investments, too. You see, for every investment vehicle in the public market, there’s a private-market equivalent. For example:

- In the public stock market, you have companies that trade on the NYSE or Nasdaq — while in the private market, you have startup shares.

- And in the public real estate market, you have REITs — while in the private market, you have private real estate deals.

The average public REIT currently pays a dividend yield of about 3.5%.

But if you know where to look, you can find private real estate deals offering yields of 8%... 10%... even 17% or more.

So, where should you look? More specifically, which states should you look in?

Survey Says…

Redfin (Nasdaq: RDFN) is a major real estate brokerage that operates in 100 markets in the U.S. and Canada.

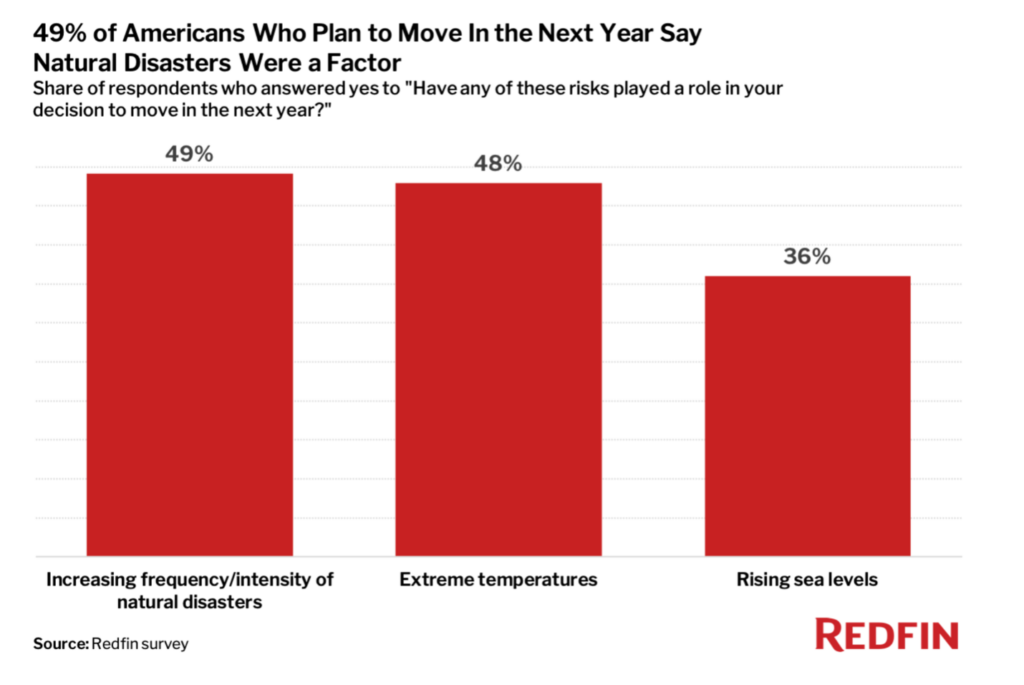

In a recent survey, it found that almost half (49%) of all Americans will be factoring climate change and its effects into deciding where to move next.

(In other words, whether you believe in climate change or not, more than a hundred million people are making housing decisions based on it already. That’s why you need to factor it in when considering an investment in real estate!)

Check it out:

“Climate change is making certain parts of the country less desirable to live in,” said Redfin Chief Economist Daryl Fairweather. “As Americans leave places that are frequently on fire or at risk of going underwater, the destinations that don’t face those risks will become increasingly competitive and expensive for homebuyers.”

For example, many people have left the Napa, California area due to an increase in wildfires in recent years, according to local Redfin real estate agent Christopher Anderson.

“After wildfires destroyed much of Napa in 2017, the community rallied together and rebuilt, but when fires ravaged our area again in 2020, some folks just decided they were done,” Anderson said. “I had one client in St. Helen whose home burned down in the last fire and only half of it was covered by the insurance company. She relocated to New York.”

If You Live in These Three States, Sell Your Real Estate Now

So first of all, let’s see where you shouldn’t be looking or investing.

For starters, you should avoid investing in areas known for:

- Extreme heat

- “Wet-bulb” conditions (extreme heat + humidity)

- Forest fires

- Rising sea levels

- Declining farm-crop yields

Generally speaking, this means avoiding America’s coastal areas, as well as much of the south, the southwest, and the Mississippi basin.

More specifically, it means avoiding three states:

Texas — I’ve always loved Texas. I lived in San Antonio when I was a kid, when my dad was training at a U.S. military base. And nowadays, I love visiting Austin and Dallas. Unfortunately, Texas is exposed to everything from floods and crop failures to extreme heat. Furthermore, the energy trend (away from fossil fuels, towards clean energy) is likely to destroy its economy.

Florida — My wife is Latin, and Miami would be a natural place for us to settle down. Sadly, at some point in the not-so-distant future, its coastline is expected to be underwater. Furthermore, what’s not underwater may soon be on fire. That explains why it’s becoming more and more challenging to get homeowners insurance there.

Louisiana — Hurricane Katrina in New Orleans was a big wake-up call about climate change. And sadly, weather-related challenges there haven’t gotten easier since. With severe flooding, crop failures, and unbearable wet-bulb temperatures, life there can be tough.

Here’s Where You Should be Looking Instead

In contrast, the northeast — with the exception of coastal areas — looks like a good bet. So do northern states including Montana, North Dakota, and Michigan.

Here are a few specific states worthy of your consideration and investment dollars:

Vermont — The Green Mountain State will actually benefit from rising temperatures. Warmer temperatures will increase its residents’ quality of life, and could help its agricultural industry expand beyond its current output of maple syrup, apples, and cheese.

Colorado — Current projections show that temperatures won’t increase in a significant way in Colorado. As a former ski-bum who lived in the state, I can tell you firsthand how beautiful and livable it is year-round.

Virginia — Similar to Vermont, Virginia’s crops would actually benefit from a slight increase in temperatures. Sure, you might want to avoid the state’s coastal areas. But plenty of places are well-positioned, including Bristol, Harrisonburg, and Norton.

A Path Forward

Now that you know a few states where you should avoid real estate investments, and a few states to consider, what do you do next?

For example, maybe you’re excited to invest in Vermont real estate — but you can’t afford a big down payment, or you have no interest in being a landlord and managing the “Three Ts”: tenants, trash, and toilets.

Well, that’s what Crowdability is here for…

If you’d like to learn more about the various ways to invest in private real estate, starting with as little as $500, keep reading these pages.

In fact, next week, I’ll show you a way to “unlock” such investments even if you’re starting with no money at all.

Best Regards,

Founder

Crowdability.com